single life annuity meaning

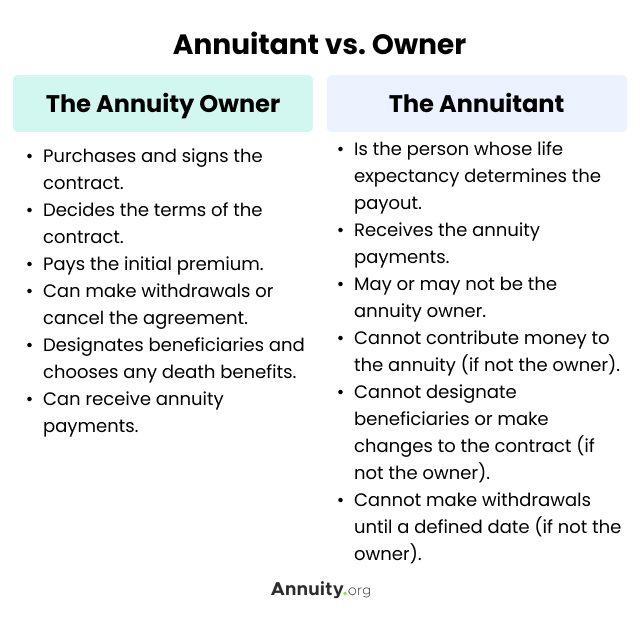

Put another way an annuity is a contract between you and a life insurance company. Deferred Annuity A deferred annuity is not a Medicaid compliant annuity.

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

If the insured dies during the term of the policy life insurance plans pay a death benefit.

. More loosely it means any regular cash flow stream which may or may not have an explicit declared term. Offers life insurance coverage till 100 years of age. The process for purchasing an annuity using money from your TSP account is the same as for starting TSP installment payments or making a single withdrawal.

If you choose a single life payout the death benefit will be. A Final Bonus might also be paid with the maturity or death benefit. You give the insurance company money either in a single large premium or in.

You can use this to get a fairly accurate estimate of the Maturity Value of LIC New Jeevan Anand plan of yours. The single-life annuity SLA is a type of annuity which pays out for the rest of the owners life. A fixed index annuity is a type of deferred annuity that offers upside potential when the market performs and downside protection from a potential market downturn.

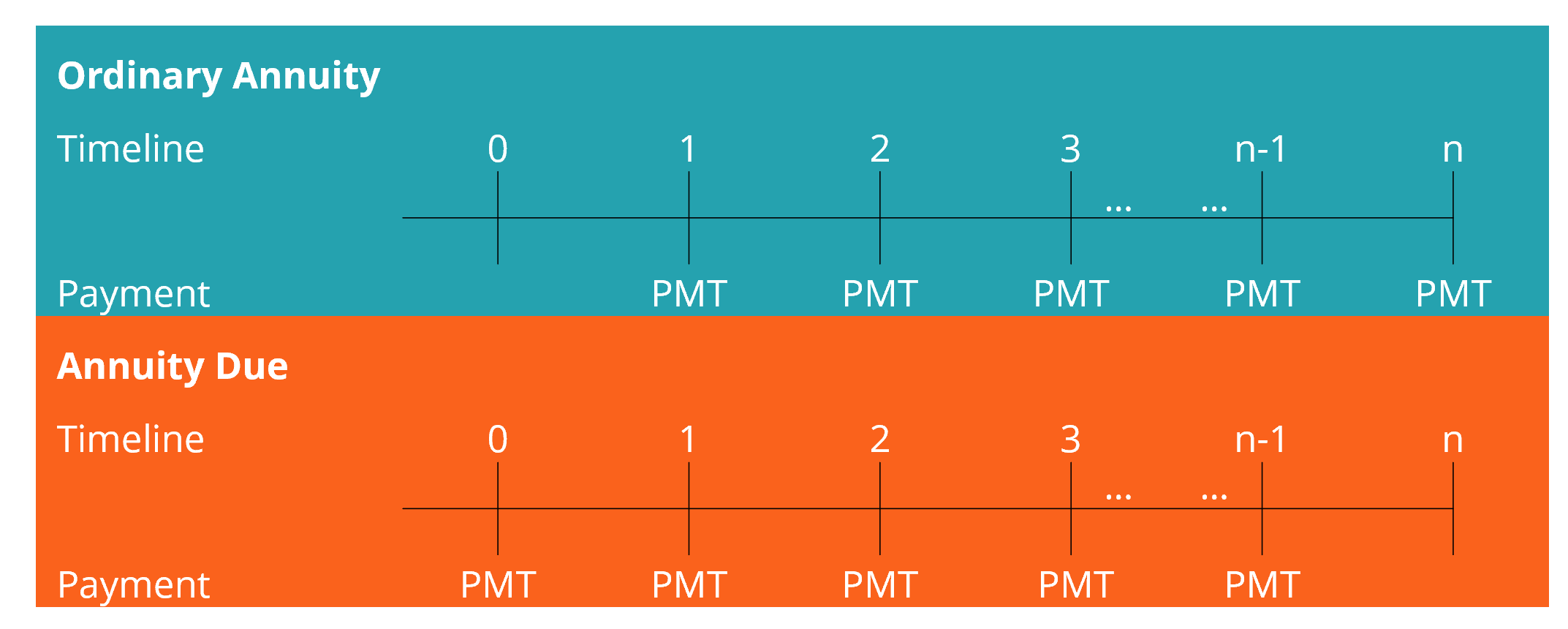

An annuity is a fixed sum of money paid someone each period typically for the rest of their life. An annuity is basically a life insurance policy set up to work as an investment. Are there alternatives to single life annuities.

The income amount will not change. This pro rata distribution combined. Lock in the current interest rates for the annuity to be received later.

If an annuity is scheduled for 10 annual payments of 10000 each the sum of the payments is 100000. Death Benefit Options on Lifetime Income Riders Single Life Payouts. We take the money from your two balances pro rata meaning in the proportion they make up of your total account balance.

Single Life or Joint Life Annuity with Certain Period. The 365 Day Advantage. He gave an example that for 200000 you may be able to purchase an income annuity that.

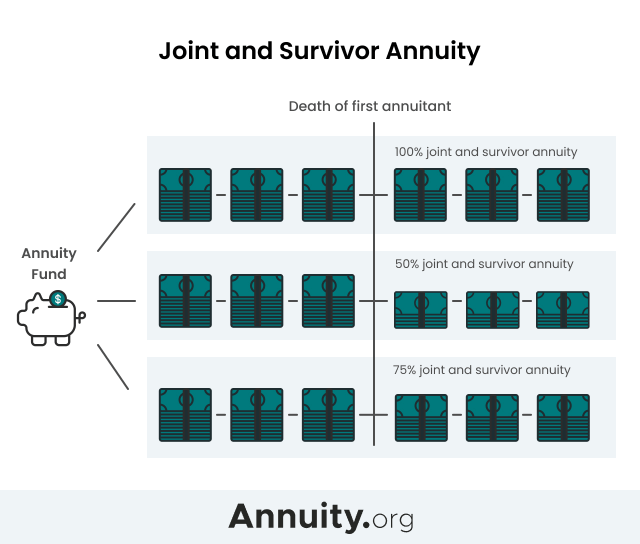

In exchange for one-time or recurring deposits held for at least a year an annuity company provides incremental. Distributes a fixed income for both the remainder of the owners life and the surviving spouses life. So lets understand life insurance meaning in details.

Single premium plan to get guaranteed income for life with the option to defer income by upto 10 years. A single life or life only annuity provides payments for the life of the annuitant. Provides the combined benefit of life insurance cum saving.

Lifetime annuities provide annuity owners an income for the rest of their life or the rest of the annuity owner and spouses lives even if the annuity has run out of money. It is one of the best LTC hybrid annuities available that also provides a 5 compound inflation protection at a highly affordable price point. Endowment Life Insurance Policy.

An annuity that is annuitized meaning converted to an income stream for the buyer immediately. An annuity that begins paying income at a future date. The State Life Annuity Care II is a single-premium deferred annuity that comes with LTC benefits.

What is life insurance. Annuity plan can cover either single or joint life Flexible payout options to suit your need 2. If your IRA is a non-deductible IRA meaning you contributed after-tax money and you did not take the annual deduction from.

Rather than guarantee an annual interest rate like a fixed annuity CD-Type Annuity an indexed annuity credits interest based on the performance of an external market index such as the SP 500. A deferred annuity is an insurance contract that generates income for retirement. An annuity is a fixed amount of money that you will get each year for the rest of your life.

Types of Life Insurance Policies. Annuity plan can cover either single or joint life Flexible payout options to suit your. Compared to other annuities that credit income growth annually on the contract anniversary Daily Advantage Income enhances the clients lifetime income by crediting guaranteed income growth DAILY.

This type of annuity makes payments for as long as one or both of the annuitants are living but for NO LESS THAN ie a minimum of a certain number of years. Tax benefits on premium paid us 80CCC of Income Tax Act 1961. Rates are based on a 100000 annuity.

The Accumulation or Account Value in a lump sum. Bonus Depending on the performance of the company simple reversionary bonuses are declared under the plan. It doesnt have a death benefit meaning upon death payments will cease.

The income start dates will be immediate after five years or after ten years. Best Lifetime Annuity Rates for May 2022. An immediate annuity is irrevocable meaning it cannot be canceled or cashed in.

Alternatively you can buy an annuity with beneficiary provisions. Single premium plan to get guaranteed income immediately for the rest of your life. This means they lock in more lifetime income 365 days a year not just once a year giving them the flexibility to retire on their own terms and still receive.

The payments which can be for a pre-determined period or for the life expectancy of the individual receiving the annuity called the annuitant start immediately upon the transaction. Your single premium grows as the AV Accumulated Value with a guaranteed minimum interest rate. Life insurance policies are designed to cover the risk of premature death.

According to Summers most traditional income annuities have restrictions on or do not include any death benefits meaning there is no provision for beneficiaries. Annuities with a single payout may not make. Provides full risk cover against any type of eventuality.

Understand the meaning and definition of annuity. However life insurance is a broad concept which cannot be summed up in the above two lines. LIC New Jeevan Anand Maturity Calculator.

Annuity Sales Pitches The Facts Behind The Most Popular One Sales Pitch Annuity Pitch

What Is A Single Life Annuity Smartasset

Joint And Survivor Annuity The Benefits And Disadvantages

How A Single Life Annuity Will Impact Your Retirement Due

Difference Between Immediate Annuity And Deferred Annuity Plans How To Plan Single Premium Annuity

Period Certain Annuity What It Is Benefits And Drawbacks

Does An Annuity Plan Work For You Businesstoday

What Is A Single Life Annuity Smartasset

Annuity Beneficiaries Inherited Annuities Death

What Is A Single Life Annuity Smartasset

What Is A Single Life Annuity Due

Annuity Vs Life Insurance Similar Contracts Different Goals

How Can You Maximize Your Pension Plan Sta Wealth Management How To Plan Pensions Wealth Management

Annuitant What It Is And How It S Different From The Annuity Owner

What Is A Single Life Annuity Definition And Payout Option

Life Insurance Vs Annuity How To Choose What S Right For You